Sensationalism and hyperbole have taken over newspaper and television reports concerning the real estate and mortgage markets. Fear-based headlines like “Mortgage Meltdown,” “Home Implosion,” and “Credit Crisis” may sell papers, but they say little about what is actually happening in our local New Bern real estate market.

I’m not challenging the accuracy of the statistics that are being reported, or the personal pain and economic hardship of foreclosures, which should be a heartfelt concern for all of us. I am questioning the choice of statistics and the spin.

Are there serious systemic challenges facing the mortgage industry today? Yes, without question. Are the dynamics of supply vs. demand, prices, and the length of time that properties remain on the market different from the environment that existed two years ago? Most definitely.

Does the bad news about financing and real estate overwhelmingly outweigh the good news? Not by a long shot!

The difficulties facing the mortgage market are primarily related to “sub-prime” adjustable rate mortgages, and they are most severe in relatively few states. And, not all sub prime loans were made to borrowers with poor credit. In many areas, a substantial number of well-qualified applicants voluntarily chose sub prime-type financing over traditional loans for a variety of reasons, including the ease of underwriting.

Consider these statistics based on data provided by the Mortgage Bankers Association: Roughly 89 percent of sub prime loans are being paid on time, or are less than 90 days delinquent. During the third quarter of last year, 92.7 percent of all mortgage loans were not delinquent, or in the process of foreclosure.

Loans underwritten using traditional standards are being made largely without any significant interruption, and interest rates are near historical lows. The mortgage market has changed - it has not shut down. Financing is readily available for qualified buyers. At the same time, underwriting requirements have become more rigorous across the spectrum of loans.

Foreclosure problems are most pronounced in seven states: California, Florida, Nevada, Arizona, Michigan, Ohio and Indiana – states that had the highest levels of speculative activity during the boom years, and in the Midwest with significant unemployment.

I’ve found that, despite declining price trends, the selling prices of most properties in the New Bern area are higher than the original purchase prices paid by the sellers. And, I’ve heard similar observations from other real estate agents around the country.

I’m not saying that the mortgage and real estate industries are problem-free. I’m simply attempting to demonstrate that, for the most part, the situation is much more positive than the national media is portraying it.

Buyer’s Perspectives:

1. Since the latter part of 2006, we have experienced a buyer’s market here in New Bern. This has created conditions that make it an opportune time for anyone thinking about buying a home.

2. The supply of homes is far greater than the demand. There are fewer buyers looking at properties, and there are increased inventories of homes for buyers to consider.

3. As a by-product of the increased supply of properties, prospective buyers should find the purchasing environment less stressful.

Seller’s Perspectives:

Market conditions such as those that we are currently experiencing in New Bern, can initially appear daunting for property owners who want to sell their homes. However, if a few simple facts are understood and acknowledged, a much more optimistic outlook emerges.

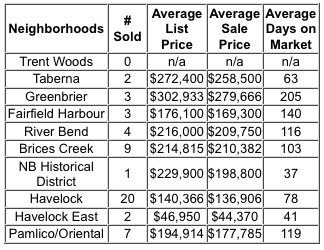

1. While the New Bern market experienced a 21 percent decline in the number of homes sold from 2006 to 2007, the average appreciation rate was still 1.1 percent. This, being at a time when some areas are observing double-digit depreciation rates. While the average time on the market has nearly doubled from 2006 to 2007, those same time-frames are very close to the 2003-2004 levels. Properties are being bought and sold all of the time, regardless of market conditions.

2. The average residential selling price in the New Bern MLS is up over 12 percent from the same measure in 2005, the year when the market peaked.

3. Sellers have the most control over the price of their properties and the condition of their homes. These are exactly the same two characteristics that buyers are seeking. Buyers are searching for the most attractively priced properties that are in the best condition.

So, as you read the newspaper and watch television, keep three things in mind:

First, real estate is cyclical, and it is a long-term investment. The reports that we are seeing and hearing focus on the short-term crisis du jour.

Second, every real estate market is local. While events in the outside world have some effect on almost every market, the statistical profile for our local environment is quite different from the national, primary-residence market, which is the basis for the reports.

And, third, I do not believe that our government will allow an economic collapse to occur, especially with elections only 9 months away.

By now, I think you can see the picture that I’m trying to paint. Nothing is ever one-sided and sometimes, it can be difficult to see all sides of an issue. However, if we take the time to do a little research, consult with an experienced Realtor® who knows the local market, and look for the positive aspects, some amazing perspectives and opportunities can be discovered.

As the famous radio commentator, Paul Harvey used to say, “And now you know the rest of the story!” Decide for yourself – is the glass half-empty or half-full?

Questions, comments, or suggestions may be sent to Dianne Dunn,

DDunn@NewBernHomes.comhttp://www.newbernhomes.com/(some parts of this article were originally published by

Tom Hranicka of Outer Beaches Realty, in Hatteras, NC)